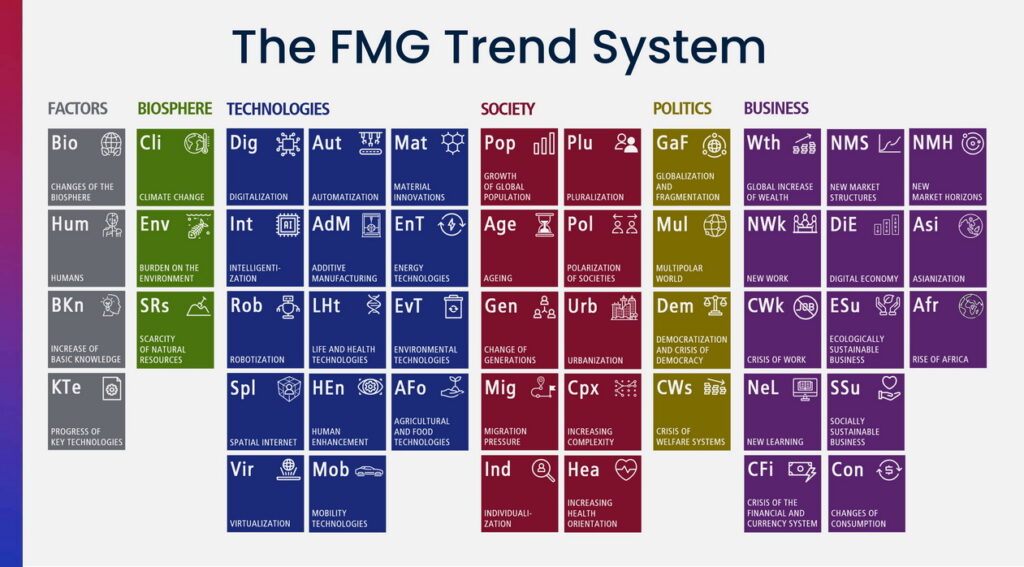

Markets worth billions, future markets, growth markets. To some, these words sound like something from a bygone era. After all, everyone knows that growth is the devil’s stuff and that soon there won’t be any left. And anyway, why does it always have to be more of everything?

I understand future markets as markets that will offer many people job and earning opportunities in the future. These are markets that will still exist when our grandchildren choose their first profession. These are markets that already exist today, are growing strongly, or are yet to emerge.

Securing existence is often already the greatest possible success

It’s easy to run a growing business. It is even easier to manage a company in a growing market. However, it is much more difficult to manage a company in an environment of stagnating or even shrinking markets. We have yet to learn how to sustain businesses with the same number of jobs and feel successful doing so. Investors in Western companies on both sides of the Atlantic must, over time, develop a new model in which revenue growth is removed as a measure of success and preservation of what exists at an acceptable rate of return is the highest to which one can aspire.

Our competitors from Asia, South America and, at some point, Africa will create an ever stronger pull in which large and good parts of our traditional businesses and jobs will gradually migrate to them. For the good of mankind, by the way, but less for the good of the local companies. Our challenge is to replace what is lost with what is new. We need to design our companies so they are not revenue growth junkies. They must be free from addiction to and dependence on growth. Growth doesn’t hurt then, but neither does deprivation.

Essentially, therefore, a success paradigm of sustaining will also be about the new and the improved, be it markets, solutions or strategies.

The three attentions for future markets

Many wonder if thinking about future markets doesn’t lead straight to dispersal. Doesn’t that mean you’re inevitably moving beyond your own core competencies? I recommend looking at future markets in three different ways. First in today’s business, second on today’s business and third for brand new business.

- In today’s business, homework must be done. Most of your leadership attention needs to be here, say 70 percent. The power producer wants to generate and sell electricity more successfully, the machine builder wants to maintain its market position. The task here is to do the necessary work on and in routine processes in an orderly, efficient and effective manner: develop, procure, produce, sell, deliver and manage. In doing so, they can learn from competitors and from other industries, engage experts, and quite pragmatically develop, improve, and simply practice strategies. The only question here is: Is our current market also a future market? Will it still exist as it is, or do we need to start creating alternatives?

- The opportunities in today’s business must be given about 20 percent of the attention, generally speaking. If you sell bathroom ceramics, the bathroom furniture is close to you. Those who sell computers will see opportunities in IT services. Anyone who operates service stations inevitably thinks of the rental car business. Those who do consulting will consider outsourcing. Since the desire to broaden the business base is often stronger than reason, many forget to ask the central questions: Are these markets really markets of the future? What other more meaningful future markets are close to our current business? And most importantly, what of it really fits our identity? Do we even have the necessary skills? Is it worth building? What are the hidden costs and disadvantages of operating in adjacent markets?

- Opportunities in new markets that are just emerging or do not yet exist should receive at least ten percent of your leadership attention. Anyone who needs numbers, data and facts to think, as is the case for today’s business, has a hard time. And yet you have to answer questions: How might these markets become relevant to us? How can we make them relevant? How could these markets destroy our current business? It is only much later that the same questions have to be asked as for opportunities in today’s markets, but much more critically.

As long as livelihoods are not threatened, keeping your hands and Euros off opportunities in new markets is pretty much always the right decision. Far too often, the desire for business adventure has been fatal. Fragmentation and the complexity that comes with it are both debilitating and stressful for any leadership team and the entire organization.

As long as livelihoods are not threatened, keeping your hands and Euros off opportunities in new markets is pretty much always the right decision. Far too often, the desire for business adventure has been fatal. Fragmentation and the complexity that comes with it are both debilitating and stressful for any leadership team and the entire organization.

However, it is more than dangerous, downright irresponsible, not to carry out the necessary observation and analysis in the first place. After all, the new markets also bring completely new competitors that are usually not even on the radar screen.

As already emphasized several times: People pay for effects. You don’t pay for products, you don’t pay for solutions, you don’t pay for technology, you don’t pay for time. It’s the simple key principle of disruption: if the same effect of today’s solution is delivered cheaper, easier, more pleasant or more effective by another new solution, today’s solution no longer has a chance. Music is “rented” from Spotify. Cell phones are replacing ECG machines. In the “shareconomy,” lawnmowers are shared with neighbors and cars with strangers found via web apps.

Create meaningful constants

Having an overview and a good understanding of future markets is necessary in all three attentions. In different ways and intensity. In any case, it is essential to determine the constants in the strategy.

The often-used concept of “core competence” really only captures part of the core. The constants have to be constant over the very long term, and core competencies rarely are. As soon as an effect desired by people can be achieved differently, even the most outstanding core competence is worthless. Look at Kodak or many a newspaper publisher. When I look at the results of core competency discussions, serious deficiencies in the language and mental maps of leaders are revealed. Often the ostensible core competencies are in reality insignificant for market success. At best, they are so vaguely labeled that everyone imagines something different. I therefore prefer to speak of capabilities.

In addition, psychological barriers make working with core competencies difficult. When the pride of the business family has been based on the production of a particular material for more than 100 years, a discussion about threatening substitutions is conducted with blinders on from the outset.

The only thing that is really constant in the markets is the effects, is people’s needs, is their striving to solve problems and fulfill desires, is their urge to improve their quality of life. If there is sustained growth anywhere, it is in quality of life, no matter what the level. Provided, of course, that we stop being so short-sighted and reckless with our planet.

Therefore: What are your “eternal” constants? What effects do you want to be responsible for? How will you achieve the effects your customers want? What technologies and business models will you use for this in the future?

In this way, you can ensure that the necessary preoccupation with opportunities in future markets does not lead you into dispersal, but rather secures the existence of your company.

Read more about Business Model Canvas – How to develop a business model for your strategy?

Follow these links as well:

► The Future Strategy Program for SMEs

► Free video crash course THE FUTURE OF YOUR BUSINESS

► BUSINESS WARGAMING for robust business and future opportunities

► KEYNOTES by Pero Mićić for your employees and customers

Have a bright future!