Case study TESLA

A vision is often understood as something that is needed. That’s what the textbook says. Many companies also only have a vision because ISO says you have to have one to get a quality certificate. So they put something down. But for really existential, for really valuable one considers completely different things. I am convinced that the power, benefits and value of vision are drastically underestimated. Why actually? Because many executives don’t realize or understand that a professionally well-crafted mission and vision can have tremendous material value in euros. Why actually? Because many executives don’t realize or understand that a professionally well-crafted mission and vision can have tremendous material value in euros.

Let’s take a concrete and current example. Let’s take a company that is currently, and in the last few years has been, virtually disrupting and revolutionizing its industry. And drives his competitors before him. Take Tesla.

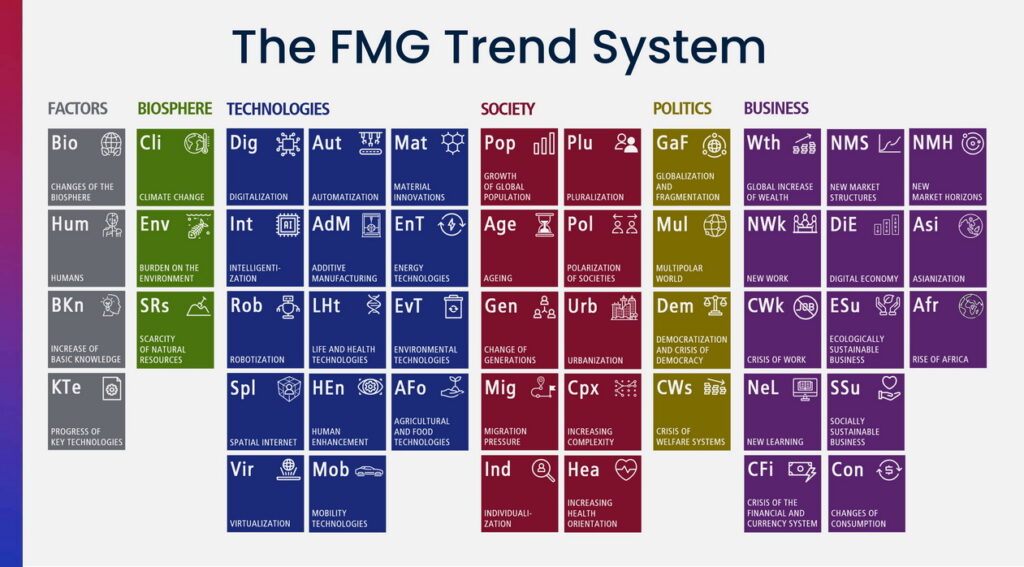

We at FutureManagementGroup AG have been telling our clients about Tesla since 2006. Back then, all we ever got was a pitying smile and, in extreme cases, a self-assured lecture about how battery electric cars don’t make any technical sense. Today, the world looks very different. Tesla is a strange company. Tesla does countless things differently than everyone else.

The car manufacturers, the OEMs, produce less than 20 percent of the value added to a car themselves, consequently over 80 percent is produced by the suppliers. Tesla, however, has over 70% vertical integration, making over 70% of the value added, i.e. the partial products on the car itself. Tesla not only manufactures cars, Tesla builds and operates a worldwide charging infrastructure with its Superchargers. And this since 2013. Tesla supplies solar panels and solar roof tiles for electricity production. And last but not least, electricity storage, powerwalls for households and powerpacks for businesses and entire regions.

Tesla’s mission

Tesla’s mission is to accelerate the shift to sustainable transportation and energy. And in the car business, the vision to become the most fascinating car company in the world.

Let’s just focus on the cars. Tesla built just over 100,000 cars in 2017. This means that Tesla is still a dwarf among manufacturers today. Since its founding, Tesla has almost consistently generated negative cash flows, and in total has only produced losses.

According to standard criteria, Tesla should have been closed in 2014 at the latest. And yet; Tesla is worth more on the stock market than most traditional manufacturers. It gets downright absurd if we divide Tesla’s stock market value by the number of cars produced and do the same for other manufacturers. BMW comes in at about $100,000 per car. Tesla, however, to an enormous 600,000. Tesla is therefore worth six times as much as BMW per car produced.

Why is that? Tesla AND BMW have production facilities, a business model, a corporate organization. The material quality of BMW, for example the gap dimensions, is still visibly better than that of Tesla. Tesla is essentially comparable to BMW in material terms. But what makes the difference? Let’s therefore subtract BMW’s per-car value from Tesla’s per-car value. We come up with a difference of 500,000. There’s obviously something about Tesla that makes it unique and hugely valued. It’s the belief of employees, customers and investors in Tesla’s bright future. To their future-robust mission and motivating vision. Investors here in particular are betting a lot of their own money on this bright future. You must be very convinced of this. You have to be more convinced of this than you are of BMW’s future, and much more so than any other manufacturer.

It’s not that traditional manufacturers don’t have a vision. Even VW and Daimler say they want to be leaders in electromobility. Incredibly, one even says they already are, even though you can’t buy a working electric car from them.

To reserve a Tesla Model 3, people lined up at night, only to pre-order a car that won’t be delivered for more than two years and that they’ve never even seen, let alone test-driven. But Tesla delivers on many – if not all – of its promises. Tesla invests almost three times as much of its sales in research and development as VW, BMW or Daimler. And when you ask Tesla drivers about their satisfaction – Would you buy this car again – an incredible 98% say YES. Despite uneven gap dimensions. This is the highest customer satisfaction in the industry. If we now multiply the $500,000 difference by the 100,000 cars produced in 2017, we arrive at the answer to our question: what is Tesla’s mission and vision worth? A whopping USD 50 billion!

Résumée

Yes, I know you are not Tesla and Tesla is a real exceptional case.

Their mission and vision will not be worth 50 billion, maybe not even one. It would be good just to recognize the tremendous value of a well-crafted, employee-enthusiastically supported, future-robust mission and motivating vision.

You will more easily attract and retain your customers, your investors and your employees. Show people a future they can look forward to. Take your chance. Don’t wait until someone comes along who has a great vision. Develop your bright future now.

X

More on the topic: The difference between mission and vision

Follow these links as well:

► The Future Strategy Program for SMEs

► Free video crash course THE FUTURE OF YOUR BUSINESS

► BUSINESS WARGAMING for robust business and future opportunities

► KEYNOTES by Pero Mićić for your employees and customers

Have a bright future!