Dr. Pero Mićić

Mercedes has unveiled a new strategy that could dramatically change not just Germany’s economy, but Europe’s as a whole. After all, the automotive industry is the key economic sector. Mercedes is largely pulling out of the lower segments of small and cheaper cars to refocus on the luxury market. This decision was made last year. But will this strategy turn out to be successful? And what does it mean for you? What can you learn from it? Let’s dig into these questions together and find the answers.

Where Does Mercedes Come From?

What does Mercedes mean to you? For billions of people, Mercedes is synonymous with luxury cars of the highest quality. The company practically invented the automobile. Back in the 1970s and 1980s, Mercedes only made large, luxurious cars. Their smallest model was the W123, which became a status symbol for the middle class. Then Mercedes introduced a new category: the luxury midsize car, known as the Baby Benz 190, followed by a luxury compact, the A-Class. If you’re old enough, you might remember the famous “moose test” associated with it. The idea was to redefine luxury, not just by size, but also by brand, features, and quality. For a long time, this strategy was highly successful.

What’s Different Today?

The automotive landscape has changed significantly. Mercedes realized this early on. They invested $50 million in Tesla for a 9.1% stake back in 2009. Mercedes sold shares continuously and sold the remaining 4% stake in 2014 for $780 million, reaping a huge profit. Had they kept the 9,1%, the stake would be worth more than all of Mercedes today, including the separated truck business.

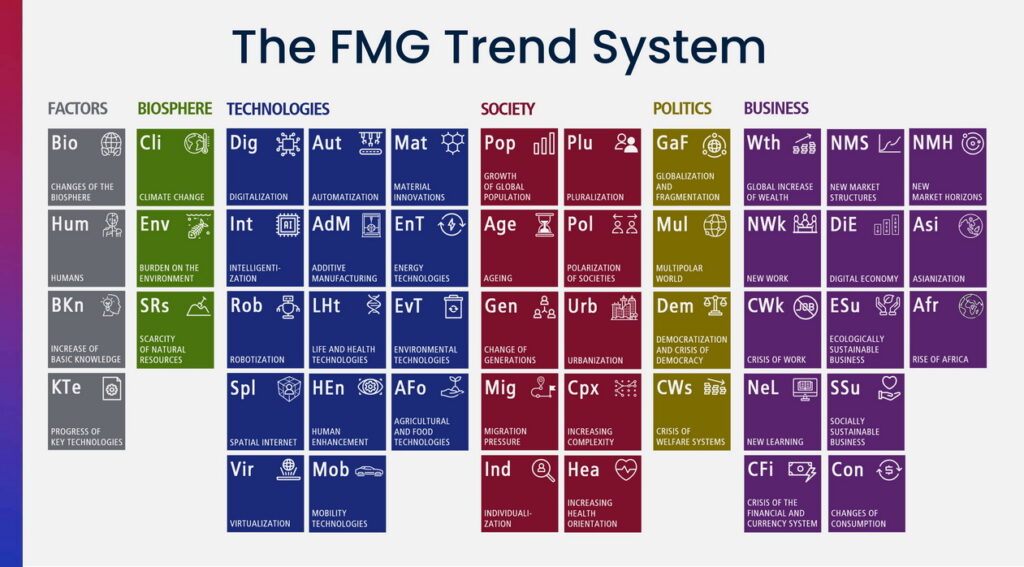

From 2006 onwards, I have been warning major suppliers about Tesla and the potential for electric vehicle disruption. Tesla has been focused on electric mobility right from the start—or rather, that was their very identity. Chinese manufacturers, particularly BYD, also entered the electric scene early. Back in 2006, we were already identifying BYD as a significant competitor in market scenarios for a well-known automotive supplier. Yes, Tesla was also considered a potential threat in our projects from 2006, even though they didn’t have a mass-produced vehicle on the market yet. Today, Tesla is driving the global automotive industry. But arrogance hasn’t ended. A German automotive executive recently told me that Tesla is just a “handicraft booth” Well, then…

From my perspective and that of my team FMG, electric mobility is clearly the future. Virtually all manufacturers have committed to offering only emission-free vehicles by 2030 or 2035. And those can only be battery-electric vehicles, as alternatives like hydrogen fuel cell vehicles stand no chance. I’ll link my articles about this in the description below. Tesla and several Chinese providers dominate the exponentially growing electric vehicle market, which will virtually take over the entire market before 2035. Market shares in combustion engines are becoming less and less relevant. Just like Nokia’s market share in old cell phones didn’t matter ultimately. What mattered was the market share in the mobile phones of the future – the smartphones. And in that sector, Apple led the way, followed by imitator Samsung as a close second.

How Does Mercedes View the Future of the Automotive Market?

Analyzing a company’s strategy from the outside is always challenging. You and I, of course, have only a fraction of the information that the executive board has.

The future assumptions made by a company, especially its leadership team, are crucial for its strategic behavior. That is, provided they act professionally and logically, rather than emotionally shaping the future to their liking. It would be wishcasting. It’s like a sailor who cannot wish for the weather but must assess the real conditions. But how can we know the future assumptions of Ola Källenius and his colleagues? Well, you don’t necessarily need to know them directly. Because these assumptions logically connect with the strategic decisions and actions, we can infer from these actions what the Mercedes leadership is likely assuming about the future. Their assumptions probably go as follows:

- By 2030, electromobility will make up almost the entire automotive market for passenger cars. Mercedes has announced that by 2030, it will manufacture exclusively battery-electric vehicles where the market allows.

- Tesla, BYD, and others will likely move from their current mid-range products further down into the mass segments. This is presumably what Mercedes assumes.

- Tesla already announced this in the first of their three master plans back in 2006. They continue to follow this plan to the letter.

- BYD has publicly stated their vision and ambition to be among the top five providers in Europe, measured by the number of units sold. This can’t happen without entering the more affordable mass segments.

- Tesla and BYD will very likely to be successful in this venture.

- Both companies have the cost advantages necessary to profitably produce and sell vehicles in lower segments. Tesla has this due to their agile culture and highly tech organization, like digital self-management, where they say that AI and data is your boss. BYD has their cost advantage primarily due to their predominantly Chinese supply chain.

- Tesla and BYD will be able to grow at an incredibly fast pace, much faster than traditional manufacturers.

- Both companies are extremely vertically integrated, contributing to 70-80% of the value chain. Traditional manufacturers contribute 20-30% of the car’s value and therefore must manage a vast network of suppliers. According to Jim Farley, the CEO of Ford, navigating through hundreds of software concepts that each supplier writes for their components makes changes for a traditional manufacturer incredibly difficult and extremely slow. This is too slow for the complete disruption from internal combustion technology to electromobility that’s happening in the next few years.

These are the likely future assumptions of Mercedes. Is this crystal ball gazing? No, when investing in business, there is no way not to make assumptions about the future. These are not predictions, but assumpions that need to be tracked continuously.

What Strategic Options Does Mercedes Have?

What would you do in such a situation? You have the following strategic options:

Strategic Option 1: Compete head-on with Tesla and BYD and quickly catch up.

Strategic Option 2: Retreat to your earlier strength in the high-margin luxury segment.

? (You don’t have any other really viable options.) Mercedes is already cooperating with other manufacturers, which would a meaningful strategy. You’d be surprised to find out where some of the engines in Mercedes vehicles come from. Mercedes is already investing heavily in research and development. I don’t see any other strategic option. Do you? Let me know in a message.

Let’s analyze these strategic options.

Strategic Option 1: You could try to quickly change your decades-old organization with the preferences, habits, and capabilities of hundreds of thousands of your own employees and suppliers. That’s akin to teaching an elephant to dance. It’s unimaginably expensive. Additionally, you’d need to genuinely believe that you could catch up to Tesla’s technological lead, particularly in software and vertical integration. Changing your company’s culture and organization while simultaneously outpacing Tesla for several years would be a miraculous feat. Forget it. You’d be accepting minimal profits or even major losses for many years, and your stock price would continue to shrink. You can’t afford that as a salaried executive. No, Mercedes stands almost no chance against disruptive competitors like Tesla and BYD in the lower segments.

Strategic Option 2: You could aim for precisely the segment that the attackers explicitly are not targeting very much. Tesla has two fairly expensive top-end models, the Model S and Model X, which only contribute a small percentage to their revenue. BYD has little chance of credibly offering luxury vehicles in Europe. But you are Mercedes. For many people worldwide, you’re still the brand that stands for luxury and quality, even if the quality has been lacking in reality for some time now. You could focus on this strength and try to actually live up to the quality claims. This would also require significant investments, but competition would be less intense. You could then tell your shareholders that you aim to increase the operating margin to 14% and the stock value from roughly 80 billion to 200 billion. This is precisely the goal that Ola has set.

Is Mercedes’ Future Strategy Promising and Robust?

With Strategy Option 1, Mercedes stands no chance. Only Strategy Option 2 remains. They have no other choice. It’s not a brilliant maneuver; it’s a fallback strategy. By 2026, Mercedes aims to increase the sales share of the top-end segment by 60% compared to 2019. They’ll focus on three product categories: Top-End Luxury with the S-Class, AMG, and Maybach; Core Luxury with E- and C-Class; and Entry Luxury, which is yet to be defined.

Mercedes had the chance to reinvent the car a second time by being a close partner of Tesla. As mentioned, their former 10% stake in Tesla would be worth more than Mercedes today. But that didn’t happen. Like almost every traditional automaker, they initially ignored, then belittled, and finally underestimated the ongoing disruption. A few years ago, they woke up and found themselves in a bind—trapped in what’s known as the Innovator’s Dilemma. Whatever they do, it will be difficult, perhaps even existentially threatening.

Could Mercedes Have Known Earlier?

Of course, hindsight is 20/20. Criticism from the outside is always easy. As mentioned, I’ve been warning large suppliers since 2006 explicitly about Tesla and the potential for electric disruption. We didn’t know for sure if it would happen, but it was a plausible scenario. For future strategies, we use our “Eltviller Model,” and here, the red glasses for the surprising future. Unlikely but potentially very dangerous. I’ll link a video about the Eltviller Model at the end of the article.

Electromobility is not new; it’s even older than internal combustion. The new aspect was the way lithium-ion batteries were built around 2000, providing acceptable ranges. Engineers at Mercedes, VW, Audi, BMW, and even GM and Ford had to know this. The case of GM with its EV1 is telling. GM terminated the EV1 project in 2003 and scrapped almost new cars. They produced it reluctantly due to regulations and wanted to continue making money with internal combustion engines. It’s a fascinating story, and I’ll link a video about it at the end of the article.

What Are Mercedes’ Chances for Success?

Today, after battery prices per kWh have fallen by more than 90% since 2010, the share of renewable energies is growing exponentially. The Chinese have learned how to build good electric cars and are now pushing European and American manufacturers out of their market, thus taking away their biggest sales market. Today, when electric cars are often cheaper in terms of total operating costs and will become even cheaper in the future, much comes too late and is too little. Too little, too late.

Mercedes has chosen the only right strategy. Basically, also the only possible one. Necessitated. Their products are already significantly more expensive than Tesla’s and BYD’s when comparing price and performance. Will they be successful with this? I consider it likely. If anyone can serve the luxury segment well, it’s Mercedes. When it comes to sportiness and driving pleasure like BMW or “Advancement Through Technology” like Audi, high-performance electric cars are already far superior and at lower costs. And to associate driving pleasure with internal combustion engine sound and gear interruptions is ephemeral and fading. “Advancement Through Technology” still exists, just elsewhere. Technology today is mainly software, as the vehicles of the future are “software-defined.” And this is where legacy automakers failed so far.

You’ve probably heard of the difficulties that VW and Audi, among others, are having with software development. For software and even the vehicle platform itself, they now have to rely on Chinese companies as partners, which are practically startups. No one could have imagined this three years ago.

Although it may sound like blasphemy to some, Mercedes, like most others, is copying many strategy elements from Tesla. Of course, no one admits it there, but where else would goals like becoming fully electric by 2030, reducing the model variety, developing a new holistic software architecture, the Mercedes Operating System, building a charging network, selling at fixed and non negotiable prices and selling 25% of cars online and over 80% directly to customers without dealers come from? These are not Mercedes ideas.

On one point, Mercedes is betting differently than Tesla. A Mercedes should also not be shared in the future, even if it can drive autonomously. They call it the “private use case.” No shared mobility. But this is more like evasion than an attack. Because Mercedes has practically given up the development of software and neural networks for truly autonomous driving at Level 5. Like many others. The Level 3 vehicles, which drive themselves under many restrictions, are far behind competitors in the final analysis and in the clear light of day, even if they present themselves as leaders there. Let’s not argue about it. The future will show it.

I hope and very much wish that Mercedes will become really successful again. For the employees. For the German economy. For Europe. Also for the shareholders. After all, Mercedes is rightfully a global brand as the inventor of the car. But I would not bet that Mercedes will remain an independent company in the long term. The same applies to BMW and others. BMW assumes that only 50% of vehicles will be battery electric in 2030. This is very risky. Not only Mercedes wants to focus on the luxury segment. General Motors, BMW, Audi, and many others want the same. Then it becomes very crowded in this fairly small segment in terms of numbers. What do you think? I look forward to your thoughts! Please send me a message …

What Can You Learn from This?

What is happening with Mercedes and others in the big business world happens every day in small and medium-sized enterprises. Please be vigilant and systematically look ahead. Have your future assumptions critically questioned again and again by employees and experts. After all, they are the foundation for every decision and for the sheer existence of your company. Play out potentially surprising scenarios in your market, conduct business wargames to expand your imagination. Get a clear picture of how your market will look different in the future. Focus on business areas where you have great opportunities and can develop good strengths. So that your company doesn’t experience what we are currently witnessing here.

At the end of the article you will find a playlist with videos on the mobility of the future. And a video about the eight characteristics of future-proof companies.

With our 32 years of experience, we are happy to work with you to develop your solid strategy to make your company more future-proof. On our website, you can find testimonials from many large, but also many small companies. Write me an email or follow the links.

Sources:

Mercedes-Benz sets out long-term ambitions as the world’s most valuable luxury car brand

Links:

► The Future Strategy Program for SMEs

► Free video crash course THE FUTURE OF YOUR BUSINESS

► BUSINESS WARGAMING for robust business and future opportunities

► KEYNOTES by Pero Mićić for your employees and customers

Videos:

Eltville Model

EV1

- Long: https://youtu.be/3fW4xYBXdGo?si=i-NPi8ztllmnokk7

- Short: https://youtu.be/l3OnYjP4FTk?si=st3Apx8kzfxICJH_

Business Wargaming: https://www.youtube.com/watch?v=VCwZW80J2OE

Mobility of the Future

- Are Electric Cars Really the Future? https://www.youtube.com/watch?v=bd5NZDZBqNM

- Hydrogen Cars? Really the best solution for the future? https://www.youtube.com/watch?v=7TNAMIgq0Ys

Have a bright future!