Dr. Pero Mićić

AI and robotics will eliminate many of today’s jobs of humans. To prevent the economy and society from collapsing, we will have to help people earn an income without working in the traditional sense. But how on earth are we going to finance that?

In this episode, I will give you my answer in the form of a master plan.

Video: Income without work

You are currently viewing a placeholder content from YouTube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationWhat is said in part 1 and 2

This is the third part of my series on income in a world dominated by AI and robots.

In the first part, I presented three scenarios of what could happen if AI and robots take over most of today’s work.

- A horror scenario in which everything collapses. When so many jobs disappear, people lose their income, they buy less, companies collapse, and so does the state because it loses tax revenue.

- An abundance scenario, in which we succeed to ensure that virtually everyone benefits from the enormous increase in productivity brought about by AI and robots, and the quality of life improves significantly for everyone worldwide.

- And a crisis scenario that lies somewhere in between.

In the second part, I presented a master plan with more than a dozen strategies for making the abundance scenario a reality. By providing people with income without them having to work in the traditional way. Above all, through a negative income tax and the accumulation of ownership of productive assets, especially in future-proof companies.

You can find the link to parts 1 and 2 in the description.

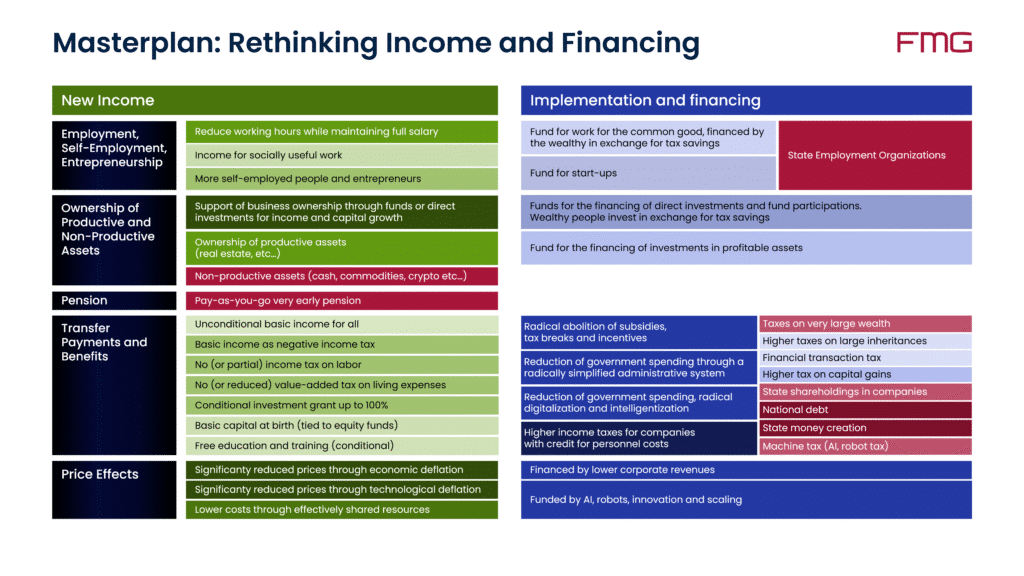

In this third part, I am presenting a master plan for where all the money is supposed to come from.

Principles: What we need to make sure

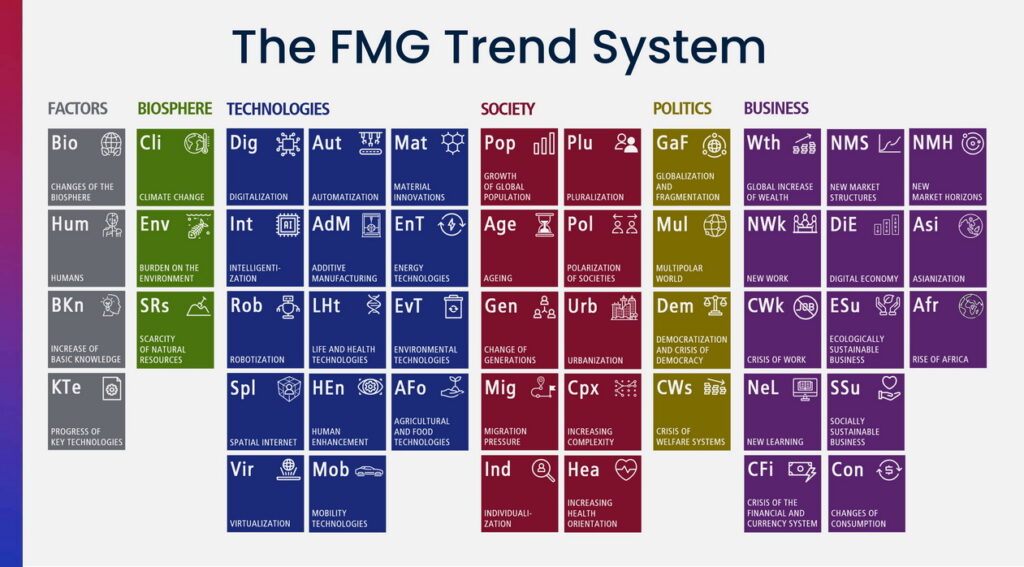

Right at the start, I want to set out a few principles that explain my and our view at the FutureManagementGroup:

- Principle: The solution must benefit as many people as possible, not just a few.

- Principle: The solution must be as simple as possible.

- Principle: The solution must be sustainable, i.e., it must be viable in the long term. Not just convenient in the short term.

- Principle 4 follows from the first three principles: The solution should involve as much private freedom as possible and just as little government action as necessary.

Everyone can easily agree with principles 1, 2, and 3. But many people see principle 4 differently and think government should play a big role. In my view, this is categorically wrong.

The state has never been a good entrepreneur and will never be. And the state is not a good implementer. Administrations grow faster than what they administrate. They subsidize nonsensical things like hydrogen vehicles. State run organizations are always far more inefficient than businesses. I am not talking about huge corporations with employed managers who don’t really bear any personal risk. I mean real private, owner-led companies who take on huge risks. They go bankrupt when they are not financially sustainable. The state can just keep on borrowing, at the expense of future generations.

Let’s take a look at how we could implement the transformation to an AI and robotics economy. I’m presenting from a European perspective but you can apply it everywhere with minor adjustments.

The masterplan

In part 2 I presented all kinds of ways to make up for losses of jobs and income

Work, self-employment, and entrepreneurship

I presented three viable options.

Reducing working time with full compensation

For that, productivity needs to be increased first. Not the other way around. Then employers can bear the additional cost. Otherwise, the state needs to pay transfers which I will address later.

Income for socially useful work

We can help finance work with funds for public welfare work, which in turn could be financed by wealthy individuals in exchange for tax savings. I am presenting this in light blue because it would be an artificially created market and there is a high risk that it would be inefficient and compete with and thus do harm to real companies.

More self-employed people and entrepreneurs

Private or public funds for start-ups of self-employed people and companies could also be financed by wealthy individuals in return for tax savings. The same tax savings should apply when investing directly in new companies. I’m painting this a slightly darker blue because it’s rather real investment than the fund for public welfare work.

Is that risky? Yes, of course it’s risky. It’s exactly this fear of risk that has brought us into the mess most European countries are in today. Because we want to rule out every conceivable risk, because we want to protect citizens from even the smallest risks, we are taking the biggest risk of all. Namely, hindering every advance and every innovation. We need to take more risks again in order to create more prosperity. Anything else is just a pipe dream.

Under no circumstances should we solve these problems with government employment agencies or government contracts. See Principle 4: The state is not a good entrepreneur. That’s why it’s dark red.

The best category of solution is

Ownership of assets

Direct investments in AI and robotics

When a person loses their job to robots and AI, the ideal investment would be to help them invest directly in profitable AI and robots. That way, they could immediately begin to earn income. The investment can be organized in various forms.

Investments in companies

Holding shares in many future-proof companies, mainly through ETFs, is the best long-term systemic solution for an affluent society. It is like retiring very early.

Investments in real assets

Direct Investments in real estate, infrastructure, or energy facilities are usually less profitable than investments in companies. But they bear less risk. Here too, building substantial wealth takes a much longer time than with direct investments in operative AI and robots.

For all three kinds of income we can build funds to finance the respective investments. Ideally private funds. If necessary, facilitated by the state. Wealthy individuals and also the treasury of organizations can invest in the funds in return for tax relief.

In both cases, investing in companies for major capital gains, unfortunately, often takes decades. It is a long time before people can live of the dividends. The state will have to provide additional support until further notice.

Transfer payments and benefits

In episode 2 I proposed a a number of solutions to provide people with income in the form of transfers, which simply means to give people money without them really working. Such transfers will be necessary as long as not all people are wealthy enough to live of the dividends on their investments.

Financing those transfers is challenging. We need to see increased productivity to generate sufficient funds. There are several ways for financing the transfers.

The cash gifts to citizens can be financed in part by the government reducing its spending. Yes, this has rarely worked in the past, but we are talking about the greatest economic transformation in centuries. If we fail, we will end up in a catastrophe. The usual self-interests must not play a role here. But in reality, of course they will.

Radical elimination of subsidies

The EU and the US maintain a complex system of subsidies. These must be applied for, reviewed, paid out, administered, and monitored. There are thousands of different subsidies. The fact that it is actually impossible to find an exact number of funds and programs says it all. In an AI and robotics economy, citizens must be subsidized directly, if at all. Everything else should be scrapped.

Subsidies assume that politicians know better what the economy and people need. This is virtually never true. For example many states promote hydrogen for mobility and energy, which defies all logic of physics and economics. It is the result of lobbying for dying industries. Furthermore, many subsidies go to large corporations who really don’t need them.

Radical simplification of public adminstration

Public administration is hugely complex and inefficient, always and everywhere. A striking example are social welfare systems. An unimaginable amount of effort is spent on administering the many social welfare funds, determining who is in need, and managing the funds. Only a small portion of this goes toward the actual task at hand; the majority is spent for administration.

This is a quote from Per Steinbrück, a German politician: “A single mother who has a father in need of care is entitled to twelve social benefits from five different ministries, based on four different income definitions, from eight different approval agencies.” That says it all.

All of this could be completely abolished with a simple solution. A negative income tax. I repeat: the administration of a negative income tax would cost almost nothing since all data and all processes are already there. It can be fully automated. The entire social welfare administration could be eliminated. Billions spent on applications, checks, calculations, and so on could be put to better use. But so far, no one dares to tackle this radical simplification. But this will have to change.

Radical simplification of the tax system

The tax system of many countries is just insane. Irrationally complicated. Yes, this too has been called for for decades but again, times will get rough.

Taxes are supposed to generate revenue for the state. That and nothing else. Instead, taxes are misused for all kinds of political interests, and then every conceivable perceived injustice is supposed to be compensated for with taxes and tax breaks. This makes tax law infinitely complicated and costs companies, citizens, and the state an unnecessary amount of time and money, without any real benefits. Moreover, it is precisely those who can afford good advisors who benefit from tax breaks.

All this shows once again how irrational and inefficient states are often organized. What is reasonable is not done because there are too many who benefit from this irrationality and inefficiency.

Digitalization and intelligentization

Once we have simplified, we can automate, digitalize, and intelligentize. It’s hard to believe: in the last ten years, many German ministries have grown by over 50% in the number of employees! Essentially, this is self-created work with no tangible benefit for citizens. The staffing levels that were sufficient in 2015 would for sure still be sufficient today. That would be a reduction by one third to the 2015 level. If we were to radically digitalize public administrations, another third could easily be saved.

Estonia is a role model for digitization. Yes, it is a small country, but it is not impossible to truly digitize and intelligentize a large country. The patchwork of IT systems alone is incomprehensible. Even a large country could be managed using a single, uniform cloud software. With even better data protection. Then we as citizens would not have to repeatedly enter the same data and provide proof in different places.

Wealth tax

Taxes on very large fortunes are a popular demand. On closer inspection, however, they are not an effective solution. First of all, this would mean taxing money that has already been taxed, which is questionable on ethical grounds.

Without entrepreneurial initiative, this wealth would not exist in the first place. Nor would the jobs.

Entrepreneurial initiative and risk must be rewarded. Building a business is an enormous effort, especially mentally.

The economy is not a zero-sum game in which one person’s gain must be another’s loss. Those who are suspicious of high incomes and great wealth among top performers, cannot even conceive of a sustainable solution. No, the economy is not a zero-sum game. The pie is getting bigger and bigger. And even a small piece of the bigger pie allows for a much better quality of life than in the past.

The size of the economy is dynamic. It is growing. That is why the prosperity of almost everyone in the world has continued to increase substantially.

Those who have created their wealth themselves have not taken it away from anyone else. Marx’s theory that entrepreneurs pocket the added value generated by their employees would only hold true if entrepreneurs no longer had any function. No more founding and expanding companies. No more developing and successfully implementing strategies, acquiring customers, performing management tasks, and so on. And if employees had no choice but to work in this company. But none of this is the case.

Mind you. The wealth of the super-rich is drastically overestimated as a source of money. Usually for ideological reasons. Or simply out of envy. Even if you took all the money away from all billionaires, it wouldn’t last long. Just a couple of months. And without global agreement on wealth taxes, the capital would simply flee abroad. A global wealth tax is highly unlikely.

It would be more helpful than a wealth tax if the super-rich directly supported the less wealthy in building up their assets directly, as I suggested earlier. Voluntarily, in return for tax savings. Then nothing would be lost in the administration of the wealth tax.

Higher tax on large inheritances

Much the same applies to higher inheritance taxes on large estates. However, we could argue that the heirs did not earn their wealth themselves and should therefore contribute a large portion of it to building up the wealth of the less fortunate. This would create more equal opportunities. We really need to help people across the board to build ownership of productive assets. Otherwise, when all goes wrong, the heirs will not be able to enjoy their unearned wealth for long. That is why I consider this to be feasible and mark it light blue.

Financial transaction tax

A tax on financial transactions would be popular. In fact, the financial sector has now become largely detached from the real economy. The abstract volume of money flows is many times greater than the real volume of the physical economy. This is not without risk. However, experience with a financial transaction tax in France, Italy, Belgium, the UK, and Sweden has not been promising. Sweden has abolished it. A global agreement is unlikely. Not even the EU can agree on it after years of discussion. In principle, a financial transaction tax to finance transfers makes perfect sense, but it is difficult to implement. Therefore, only light blue.

Higher tax on capital gains

In all major economies, capital gains are taxed at significantly lower rates than income from work. In China and Switzerland, private capital gains are even largely tax-free. In addition, in most countries income from work is subject to very high social security contributions. Capital gains, on the other hand, are not subject to social security contributions.

Yes, the aim of lower capital gains taxes is to promote investment through tax advantages for capital gains. Nevertheless, in an automated world, it is no longer fair that capital owners who do not work pay so much less tax and social security contributions than people who have to sell their labor. It should be equally taxed, which would also simplify the tax system. I am an investor myself but we have to see the bigger picture without self-interest.

State run companies

Principle 4 prohibits state holdings in companies as a matter of principle. It is not the state’s job to run companies. Nor is it its strength. On the contrary.

Debt and money printing

I have marked government debt used to finance transfer payments in dark red. Firstly, because most countries are already heavily indebted and, more importantly, because it would be debt for consumption. This contradicts Principle 3. It is not sustainable. It only shifts the problems into the future, makes them even worse and is absolutely not a sustainable solution. In the long term, it leads to financial disaster.

This applies even more so to money creation by the government, commonly referred to as money printing. The more money the government creates and spends, the faster and more severely it destroys the economy and thus society. So, absolutely dark red.

AI and robot tax

The old idea of a machine tax is often proposed for funding of transfers.

But if there is to be a machine tax, which would now have to be called an AI and robot tax, then there would also have had to be a steam engine tax, a car tax, a computer tax, and a software tax. Anyone who implements SAP would have to pay tax on it because jobs are being eliminated. This would mean taxing innovation and progress. Not a good idea. In addition, an AI and robot tax would put companies at a competitive disadvantage if competitors in other countries don’t pay such taxes. And it is extremely unlikely that all countries would agree on this. I will show you a better option in a moment. So, red category for the AI and robot tax in its pure form.

Higher income taxes for companies

Let’s take once more a look at the big picture. What will happen? AI and robots will take over a large part of cognitive and physical human work. And at a much lower cost. Who will use AI and robots? Companies, of course. They will become significantly more productive. They will generate significantly more revenue and profits. If, big if, customers have the money to buy their products. The big problem is that many people will lose their jobs, in virtually all companies. So what’s the obvious solution? I see the most suitable source of funding in higher income taxes for companies.

And I say this as someone who has been an entrepreneur all my life. Ideally, the total amount of salaries paid would be taken into account. Companies who still employ a lot of people would pay less tax than those that are fully automated.

As I said, the best solution would be for people to have a stake in companies. However, since this cannot happen overnight, higher income taxes for companies can address the cause and effect precisely.

This source of funding for transfers is also elegant and simple because a company’s profits already have to be documented with utmost accuracy. Then “all” that remains is to ensure that the few percent of international companies no longer can reduce their tax burden to minimal amounts. A different definition of taxable profit or a global minimum tax might be a solution, on which good progress is already being made.

Price effects

How should the massive price reductions be financed? Quite simply. This happens automatically as companies are in competition with each other and with lower cost through AI and robots there will be a pressure to reduces prices so they generate lower revenues. There will be massive deflation of almost all goods and services. There is no need to actively address this issue.

Conclusion

The master plan

That is the master plan. Yes, it is complicated and complex. It is a space of possibilities. A range of solutions. The darker green the new types of income on the left-hand side and the darker blue the implementation and financing strategy, the more effective and meaningful they are. Some are effective quickly, such as basic income as a negative income tax, while others only have a long-term effect, such as building up productive assets for as many people as possible.

Each country will choose its own mix. Some governments will do it more intelligently and with more foresight, others less intelligently, more ideologically clouded and thus more short-sighted. The world is the way it is because people are the way they are.

Call to action

We are facing the greatest and fastest transformation of our lives and work ever. We have a lot to look forward to.

What the master plan shows: We are not lost in an AI and robot economy and do not have to end up in a horror scenario of economic catastrophe. Quite the contrary. It will not be easy, but we have enough options and opportunities to make the transition to a healthy and prosperous society with quality of life that is unimaginable today. If we act in a timely and future-intelligent manner.

What mix of measures would you choose? Where do you see a need for further reflection and discussion? Write your thoughts in the comments!

Please share this article with your friends and family. Far too few people are truly aware of this massive coming transformation.

If you want to improve and future-proof your company, send me a message. We have been in the business of foresight and strategy for 34 years now. And become a member of Bright Future Leaders where we share for free all kinds of insights and tools on the Future, Strategy, Innovation and Leadership.

Have a bright future!

Here you can find the other articles on AI and robotics:

– Humanoid robots: The solution to the labor shortage? (Part 1)

– Humanoid robots: How intelligent will they be? (Part 2)

– Humanoid robots: How will they learn? (Part 3)

– Humanoid robots: How much will they cost?

(Part 4)

– AI kills all jobs – and then what?

Three scenarios (Part 1)

– Prosperity through AI, but how? (Part 2)

– Make a living in the AI-economy. 13 effective hacks (Part 4)