Dr. Pero Mićić

If AI and intelligent robots take over most human jobs, including yours, how will you earn your income?

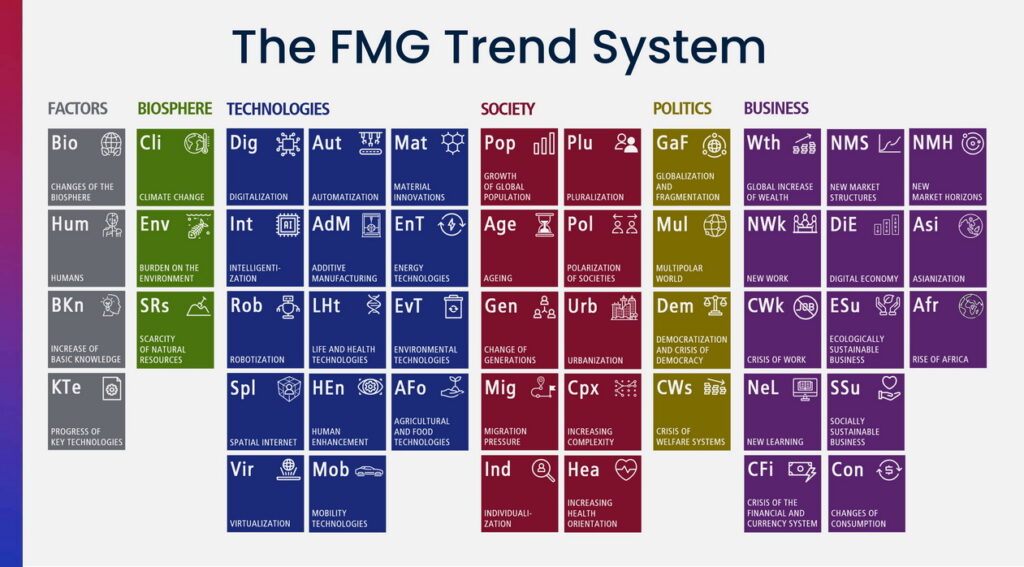

We are facing the biggest and fastest transformation of our economy and the world of work. And with it, our society. How people will earn an income in a world of work that is highly automated with AI and robotics is nothing less than the all-important question for the future of our time. Unfortunately, politicians haven’t addressed this question so far.

This is the second part of a series of articles. In the first part, I presented three scenarios for an AI and robotics society.

In this second part, I develop a master plan with which we can make the transformation people-friendly and massively increase the quality of life and prosperity for all.

Come with us on an exciting journey of discovery.

What could our future look like?

Artificial intelligence is conquering the virtual spheres of work at a breakneck speed. With humanoid robots, it will soon enter our real world as well. AI and robots will be able to do most jobs better, faster and cheaper. First in production and logistics, then in service and finally in your home. The factor labor will no longer be scarce due to AI and robots and will therefore become increasingly cheaper.

If we can make AI and robots work for us, we could actually have a comfortable life. If it weren’t for one serious problem: Who will pay you? And for what?

If we don’t find a solution to this problem, we will end up in a horror scenario with the total collapse of our economy and our society. Companies will see their sales plummet, many will go bankrupt. The national budget collapses because hardly anyone pays taxes. Society becomes aggressive and votes for radicals. Totalitarian regimes with supposedly strong leaders seize power and nationalize everything. Freedom dies. We will experience this horror scenario if we do nothing or the wrong thing. Then the total economic collapse is almost certain.

If we do too little too late, we will end up in the crisis scenario. Bad enough, because it also means a drastic decline. For the sake of brevity, I’ll leave it at that and just focus on the two extreme scenarios.

In the abundance scenario, our future will be really bright. With AI and intelligent humanoid robots, we have a great opportunity to take a major leap forward. The highest quality of life and health, without the stress of work and with much more time for family, friends and hobbies. Yes, this is possible and achievable. If we do the right thing in time.

But what is the right thing?

The fatal flaw in our economic system

We must and may rethink work and income. Because we have a fatal flaw in our current economic system.

In the course of industrialization, we have built the entire economy on the premise that entrepreneurs create jobs and over 90% of people are employees who depend on these jobs. They work on behalf of the entrepreneurs and receive a salary to make a living. This system has worked reasonably well so far. It has given almost everyone a better quality of life. But this system cannot survive a very rapid automation of a large part of work by AI and robotics. Because most people will then no longer be able to earn an income from traditional work and will no longer be able to buy anything. Our current economic system would collapse.

In short, the problem is not AI and robotics, but the economic and political system based on human labor.

How can we achieve he abundance scenario?

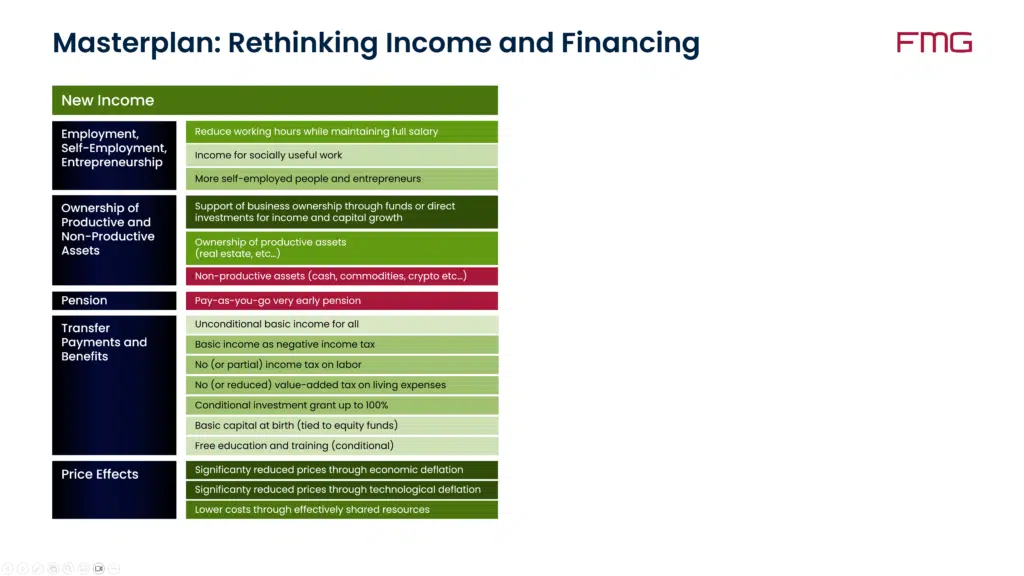

The new economic system must enable people to have new types of income. And we have to find solutions to finance it. Let’s take look at the types of income you might have.

Work, self-employment and entrepreneurship

Reduction of working hours

The first idea, of course, is to reduce people’s working hours while maintaining full pay. Employees who routinely use AI and robotics are significantly more productive. This potentially creates more value and lowers costs. Then the regular salary can be paid despite less working hours. John Maynard Keynes described it in the 1930s. Technology frees people from the necessity of spending most of their lives working. Keynes wrote that you will only work 15 hours a week. We have been moving in that direction for the last two hundred years. Officially, employees have never spent so little time at work as they do today. This trend will continue in the future.

Many jobs will gradually require less and less time. But many jobs will disappear entirely. A team of programmers can get by without low-skilled coders because AI can write, test and improve the code. But the best developers will remain on the team as software strategists and architects, producing much more useful code than before.

If we finally stopped paying employees for the time they invest and started paying them based on the value they create, it would be much easier to reduce working hours.

But with today’s productivity is it not viable to reduce working hours while keeping pay the same. We would weaken or even destroy our companies in the global competition, especially with the Asians. Productivity has to increase before or at the same time as we reduce working hours. Not afterwards. Demands for a four-day week largely ignore this need for demonstrably higher productivity beforehand.

They are mostly just about more free time. Often at the expense of the employers, who are already supposed to bear all kinds of burdens. And it must remain the independent decision of companies how many people they employ. Otherwise we will end up with socialism. Reducing working hours will very likely be a partial solution. Therefore shown in medium green.

Income for socially useful work

Employees, the self-employed and entrepreneurs can earn income through socially useful work for which there is currently no market. For example, in the care of children, people with disabilities or the elderly, or in environmental care and protection. This option is light green because it requires that this market would need to be created artificially.

More entrepreneurs

A very good strategy would be to have more self-employed people and more entrepreneurs. Why? Because they can tap into new fields of business and sources of income more flexibly and innovatively than employees can, because they can only do so within the framework of their employment contract or by changing employers. And above all, because companies are the only ones that can really create jobs. Entrepreneurs are the engines and generators of prosperity. Without people acting as entrepreneurs, there are no companies, and therefore no jobs. Also, no taxes on profits and salaries. Thus, no public service and no civil servants. It is incomprehensible to me how often this connection is ignored. We need many more self-employed and entrepreneurs!

I should actually show it in dark green, but it would not be realistic. Because the majority of people obviously do not want to be self-employed or entrepreneurs. For whatever reason.

Pensions

Let’s skip the ownership of assets for now. I’ll come to that later.

Politicians will definitely propose a very early retirement within an intergenerational pension system. This is a system where the pensions of retirees are financed by the contributions of working people. This is the case in many countries. However, I am showing it in dark red because it simply cannot be financed. The pension systems of most states are already heading for disaster. The intergenerational pension was a short-sighted mistake of the century. People will always have children, German chancelor Adenauer proclaimed in the 1950s when they changed to this unsustainable system. It was demonstrably known as early as the 1930s that in Germany fewer and fewer working people would have to finance more and more pensioners.

With the decreasing number of working contributors and their income shrinking, the pension system will collapse with absolute certainty. If you think about the consequences of an AI and robotics world and the solutions for it, you could, in principle, completely abolish the pension system. We will see later why this is not a totally crazy option.

Transfer payments and benefits

Unconditional basic income

An unconditional basic income is the solution most often proposed for an automated world of work. In principle, a UBI can be a solution. However, it has several shortcomings. By definition it would be paid to everyone, including those who don’t need it. Furthermore, from an ethical and philosophical point of view, I believe it is wrong that people receive something from society without giving anything back to it. Sustainable systems don’t work that way.

Until now, a basic income at a sufficient level was simply not financially viable. Because today’s productivity and tax revenues would simply never be enough for it. But with AI and robotics, we can increase productivity enormously. A UBI becomes a viable option. But there is a berter one.

For this reason, I show the unconditional basic income in very light green.

Basic income as negative income tax

A basic income in the form of a negative income tax would make much more sense than an unconditional basic income. A basic income would have to be paid immediately to everyone. A negative tax, however, would automatically adapt to the progress of automation and the increasing loss of paid work. And it would only be paid to those who really need it and only in the necessary amount.

How would it work? The tax authorities know exactly, down to the last cent, who earns how much. The amount of the basic income could be based on a generous basket of goods. How high it should be will certainly be the subject of heated debate.

When filing your taxes, software can calculate automatically who doesn’t earn enough. If it’s less than the minimum income, the tax authority pays out a supplementary amount that allows you to live well. Again, all of this can be fully automated. Already today. The entire administration of social benefits and welfare is already completely superfluous.

Even a negative income tax should not be completely unconditional. Because of the principle of social reciprocity. A basic part could be unconditional. But additional amounts should be conditional. What conditions could there be? Those who are not confirmed as being unable to work should prove that they are doing socially useful work or are socially engaged, for example in caring for children or the elderly. Or in preservation of nature. And you should have lived in the respective country for a while. Also, the amount of income could depend on age or the number of children. What is really important is that the system for finding out who meets the conditions is very simple, ideally fully automated. Under no circumstances should it lead to a new administrative monster.

No income tax on labor

If the state is to provide income for its citizens, it makes no sense to take a large portion away from them beforehand. The tax on income from labor could be abolished altogether or at least up to the level of a good salary. We will look at the financing in the next episode.

No VAT on living expenses

For the same reason, VAT on general products and services could be abolished. Luxury goods, however one defines them, could remain subject to a progressive VAT rate. But since we can and must rethink everything, we might as well take the opportunity to radically simplify and abolish VAT. The laws for which is insanely complex in many countries. Yet taxes are simply supposed to generate revenue for the state. There are simpler and more meaningful ways to do this, as we will see in a minute.

Conditional investment grant

The massive transformation brought about by AI and robotics should encourage us to consider even very bold ideas. A basic capital paid out at birth sounds crazy, but on second glance it is a promising concept. For example, every newborn could get 100,000 dollars. The capital must be invested in a broadly diversified equity fund and would be inaccessible before the age of 60. However, it can be deposited as collateral for loans, with state support. I will come back to such investments later. Unfortunately, this solution would only work in the very long term. That’s why it’s only light green.

Basic capital at birth

The massive transformation brought about by AI and robotics should encourage us to consider even very bold ideas. A basic fortune at birth sounds crazy, but at second glance it is a promising measure. For example, every newborn receives 100,000 euros. The assets must be invested in a broadly diversified equity fund and would be inaccessible before the age of 60. However, it can be deposited as security for loans, supported by the state. I will come back to such investments later. Unfortunately, this solution would only work in the very long term. That’s why it’s only light green.

Free education and training

Not exactly income, but a prerequisite for income would be more free education and training. The demand for professional and personal training will increase enormously due to AI and robotics. AI will make most of the purely technical training almost free of charge anyway. Free education and training is fundamentally good, but only to a limited extent. If opportunities for human work become scarce, the state should refrain from offering its own products and services. It is better when people receive an income to choose and pay for educational services themselves. That is why it is only shown in light green.

Price effect

Deflation

For most products and services, prices will fall massively due to economic and technical deflation. If you largely take out the labor costs included in all products and services, prices can drop to a fraction. Higher productivity through innovation and economies of scale further reduce manufacturing costs. This will make it much easier for people to pay for their living expenses. As a result, you will be able to afford much more with much less than with your current income.

Competition must be kept strong so that monopolies or oligopolies with only a few providers can be prevented. With a lot of competition, prices will really come down for sure. I show this in dark green. The deflationary effect on prices is easily underestimated.

Shared resources

If we share resources more effectively, we can use them much more cheaply. For example, AI-controlled robotaxis will make individual mobility significantly cheaper because, firstly, the vehicles do not need a driver and, secondly, a car will not only drive for an hour but for 15 or more hours a day. Sharing resources reduces costs and protects the environment. If you can simply use an app to get a vehicle in three minutes, car sharing becomes really convenient.

Ownership of assets

Now to the area that, in my view, offers the ideal long-term solution. Promoting the building of profitable assets to make a living without traditional work.

Ownership of unproductive monetary assets

This is, in principle, the second fatal flaw in our economic system: the fact that saving money is presented as a reasonable option. Money is not productive as such. The interest earned on deposits and loans is only a small part of what others earn in income when they actually invest the money. On the stock market, for example, they earn an average of nominal 8%, and often a multiple of that. As a rule, inflation eats away the interest you get on savings. Even worse is cash with no interest at all and which therefore keeps decreasing in value.

It’s tragic. Many governments in many countries have effectively forced entire generations of employees to save in the form money, i.e. in life insurance, pension contracts and savings contracts. After inflation, the real return is often even negative. You can’t build a fortune that way. It was certainly not intentional, but by saving in money, most people have been left without significant assets for decades. They were and remained dependent on their earned income. This is now coming back to haunt us.

Ownership of unproductive raw materials and crypto tokens

Some promote ownership of unproductive tangible assets. Assets are unproductive if they do not directly generate income. Gold and commodities do not generate income. Cryptocurrencies usually do not either. This are supposed to secure value and at best grow in value. But their value can also fall, as we have often witnessed. This is unsuitable for sustainable wealth accumulation for the masses. Yes, I have also invested in cryptocurrencies. It may well be that Bitcoin is growing in value very strongly because of the limit of 21 million.

But it is still highly speculative. I don’t think we can or should build an economic system on it now.

Ownership of productive assets: real estate

Real estate is productive capital. You can generate a return by renting it out. In principle, this is okay, but the returns and thus the resulting income are relatively low compared to stocks. Especially since it is highly unlikely that there will be any significant real increases in value in the future, with a shrinking population almost everywhere, apart from Africa. In addition, real estate will hardly benefit from AI and robotics. Rather the opposite. And real estate is immobile and hardly fungible. It always represents a cluster risk, even when investing in real estate funds.

Ownership of productive assets: companies

Who is not afraid of the effects of AI and robotics on their income? Exactly. The owners of companies that would benefit from AI and robotics through much higher productivity. If, of course, their customers have the money to buy their products and services.

By far the most effective measure is to make as many people as possible owners of companies or shares in companies.

Investments in AI and robotics companies

Direct investments in companies that sell AI and robotics services to other companies would be ideal. Like personnel leasing companies. If someone loses their job in production, logistics or service to robots, we should help them to invest in precisely such robots. If the truck driver loses their job to an autonomous truck, we should support them in acquiring ownership of such a truck. This could be done through new purpose-built companies that buy AI systems and robots and lease them out to companies. As many employees as possible should be shareholders in such companies. Then they will benefit directly from AI and robotics. We could also create funds that invest in several such companies to spread the risk.

Such companies would very likely have significantly higher returns than ordinary equity funds. Because the increases in productivity and thus the income from AI and robotics will show enormous growth rates.

The best part is that substantial returns are achieved right from the start so that the new shareholders can at least partially live on them.

This is may darkest green option.

Investments in diversified equity funds

A safer, but therefore also less profitable, investment is in broadly diversified equity funds. It would only work in the longer term because dividends are usually insufficient and significant capital gains need a decade or more.

History is proof that investments in broadly diversified equity funds generate significantly higher returns and capital gains than investments in real estate or other assets. The only requirement is buy and hold. In other words, long-term investment without frequent buying and selling of shares.

The investment return triangle presented by a German equity institution clearly shows an average nominal return of over 8% from a broadly diversified MSCI world fund with several thousand companies. There are very few years when you simply should not have sold shares to avoid a loss. Even in a crash, you lose nothing if you wait two to three years.

In the long term and in the big picture, you cannot lose money. This is sustainable, because in the long term, wealth continues to grow. A long holding period protects you from crashes, and the broad diversification across several thousand companies also protects you from major bankruptcies of single companies or even entire industries.

From a one-time investment of 100,000 dollars, for example from a basic capital at birth, with a conservative 7% instead of 8% average nominal annual return, 2% inflation and thus real 5% turns into almost 1.9 million dollars in purchasing power in today’s value within 60 years. From that point on, with a real return of 5%, you can withdraw up to €7,700 per month before taxes without depleting your assets.

Many people will still be able to make additional monthly investments on top of their initial investment. A monthly investment of 500 dollars then results in a real 744,000 dollars in purchasing power after 40 years. Then the sustainable monthly withdrawal increases to 10,800 dollars before taxes from the age of 60.

Wealthy independent citizens and a financially healthy state

If almost all people had substantial ownerships in companies, there would be more equality of opportunity than with countless and enormously complicated and expensive social welfare systems. In the long term, it would create a society of citizens who are wealthy, free in their decisions and more independent of the state. Citizens would pay taxes, but would not need or demand anything from the state and society. They would no longer be dependent on state benefits. They would not be a burden on their fellow citizens. And state finances would be very healthy and sustainable.

And last but not least, the wealth can be passed on to the next generation, enabling them to live even better. Each new generation would be better off than the one before. Unfortunately, the opposite is happening right now.

Yes, of course, we can continue to pay social benefits to people. We can support them. But that is not sustainable, as the deficits in almost all countries show. It is also unworthy of human beings. The saying comes from China: “Give a man a fish and you feed him for a day. Teach a man to fish and you feed him for life.” We should help people to provide well for themselves.

A population of business owners would be the long-term solution that would help people achieve lasting prosperity. That is sustainable. That is humane. Then people are indeed free.

Unfortunately, this solution will not work in the short term. It will take time for most people to build up enough productive wealth to make a living from it. Therefore, transfer payments like a negative income tax will be necessary for the time being.

Together with direct investment in AI and Robotics companies, I show this option in a deep dark green, because these two are the best long-term solutions.

The false fear of risk

Most politicians, especially in Germany and other European countries, consider investments in companies to be too risky. The term “gambler’s pension” for stock based pensions is indicative. Those who say this do not understand how an economy works. In real life, such an attitude prevents the population from accumulating real wealth. Instead, we have implemented incredibly stupid pension systems that are generating a supposedly safe 1 to 2 percent real return on financial assets. If at all. Due to inflation, real losses are not uncommon.

The only thing that is certain about that is that people’s capital remains miniscule. Stocks with a real 5% they deem too risky, but they force citizens, with a sure 100% probability, to give up the majority of the return and leave the real profits to the investment professionals. Without this fatal flaw, the problem with automation would not have arisen in the first place. It’s incomprehensible.

Now what?

As you can see, there is a wide range of tools available to help regular people make a good living without traditional work. Every country will do it differently. Some will do it more intelligently, others less so. The future-intelligence of politicians is the deciding factor. This means being intelligent when making decisions for the long-term.

We can and in the long term we will all live in good health and great prosperity. Each of us. But to achieve that, we need to change our economic system. For most people, being a traditional employee is not a viable model in the future.

Even for you, your family and your friends, it is necessary to consistently begin implementing the most effective measures today. Namely, to build up ownership of productive future-proof companies as quickly as possible.

The key question now, however, is how we are going to finance all of this. We will answer this question in the next article. You will find the link here as soon as it is published.

Have a bright future!

If you want regular practical tips and strategies for your future management, free of charge, become a member of our “Bright Future Leaders” community.

Here you can find the other articles on AI and robotics:

– Humanoid robots: the solution to the labor shortage? (Part 1)

– Humanoid robots: will they be intelligent enough? (Part 2)

– Humanoid robots: how will they learn? (Part 3)

– Humanoid robots: how much will they cost?

(Part 4)

– AI kills all jobs – and then what?

Three scenarios (Part 1)